Table of Content

Despite the fact that home loans are now a commonplace service at all established financial institutions, it is crucial to conduct a thorough research before you apply for home loan. Understand the benefits, rate of interest and other important fees before starting the process. All these things have a long-term impact on your overall repayment schedule.

Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. A hike in the MCLR rate by 10-basis points will change the loan interest rates of HDFC bank for both new and existing borrowers from 7 September 2022. This will be applicable for home loans, vehicle loans, or any other loans equated to monthly installments. As per the revised rate, there has been an increase of 8.2% in the bank’s one-year MCLR, and it also shot up by 7.9% overnight. The MCLR will be 7.90%, 7.95%, and 8.05% for the one-month, three months, and six months tenor, respectively.

Fixed Rate Home Loans and Floating Rate Home Loans:

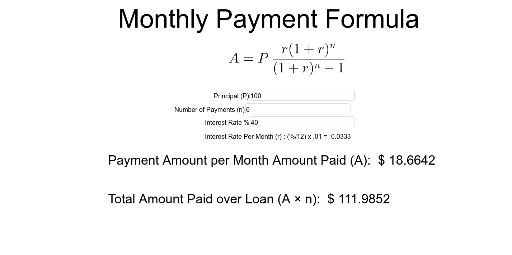

EMI calculators prepare you for the Home Loan by predicting the potential EMI payable even before your home loan is sanctioned. Enter the principal loan amount you need, a reasonable interest rate, and the loan’s tenure. The online tool will compute the EMI amount instantly. B3 Silver Account comes with maximum savings and zero Quarterly Average Balance .

Available on lending institutions’ official portals and on third-party websites, such calculators derive equated monthly installments by using just three sets of information. You can also use a Home Loan Calculator if you need to calculate EMI for your housing loan. The home loan prepayment EMI calculator is offered by various third-party websites.

Rates & fees

Remember, the longer the tenure is, the lesser would be the EMI. If you choose a shorter tenure, it automatically confirms that you will have to pay a considerably larger EMI. You are never too far away from quick, efficient banking services. You can pay off any existing balance of Home Loan using Kotak’s Home Loan Balance Transfer at a lower rate of interest. I preferred Kotak bank over other banks due to lower rate of interest and my existing relationship with Kotak Bank. ╳ Applying for a house loan on different aggregator sites may lower your chances of approval.

The home loan EMI calculator also functions as a home loan interest calculator. The online home loan EMI calculator as a tool aids in deciding if you can afford the required financial commitment for a home loan in the long run. Top-up Loan allows customers to avail of a certain amount of money, over and above the existing Home Loan. He inputs these details into the Money View rate of interest calculator. Based on the calculations, his monthly EMI will be Rs. 7,007 and the interest component comes up to Rs. 2,007.

HDFC LTD Home Loan Reviews

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. I hereby give my consent and authorise HDFC Sales Pvt. Ltd. and its affiliates to call / email / SMS me in relation to any of their products.

A personal loan is an unsecured, lump-sum loan that is repaid at a fixed rate over a specific period of time. The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow, the interest rate, how much time you have to pay it back, your credit score and income. One of the most integral parameters in deciding your home loan is the equated monthly instalment that you will have to make against your housing loan. This is where a Housing Loan EMI calculator comes in handy. It is an automated system which helps you calculate home loan EMI. A clear knowledge of the amount which you will have to bear every month will assist you to make a more informed decision.

However, it should be kept in mind that the amount will be disbursed in instalments as per the assessment of the lender. What are the Minimum home loan eligibility requirements for an NRI? In general, the home loan eligibility criteria for NRIs are in line with that of the general public.

EMI calculation is made in two ways i.e. flat balance method or reducing balance interest rate method. Follow the simple steps below to calculate your monthly EMI online and plan your finances effectively. Down payment - The down payment is money you give to the home's seller.

Such loans like SBI MaxGain allow you to deposit your extra savings in a current account which is linked to your home loan account. Therefore, the bank will calculate your interest after deducting the balance in your current account from the outstanding principal amount. Also, you can easily withdraw your money from the current account whenever you want. Looking to make a partial prepayment against your home loan? Use the Home Loan Prepayment Calculator to find out how much you will save on interest and how it affects your home loan EMI. Simply enter the loan amount, tenure, rate of interest, instalments paid, and prepayment amount to see the results.

For a personal loan of Rs. 5 lakhs with a repayment tenure of 5 years and an interest rate of 11 % per annum, you have to pay an EMI of Rs. 10,871. The total amount payable will be Rs. 652,273, of which Rs. 152,273 will be towards the interest. If you want to borrow a personal loan of Rs. 20 lakhs at an 11 % per annum rate of interest for a period of 5 years, you have to pay an EMI of Rs. 43,485 per month.

A Home Loan EMI Calculator is an online calculator that lets you calculate your monthly loan instalment amount with ease. All you need to do is enter your preferred loan amount, the interest rate offered, and loan tenure. Upon clicking the “Calculate” button, you will get 100% accurate results pertaining to your home loan EMI.

Borrowers should prepare for more increases in loan interest rates as experts predict that the central bank will raise policy rates in the future. A borrower can choose to extend the loan's term if they are unable to make the increased EMI payments. Kotak Mahindra Bank provides personal loans from Rs. 50,000 to Rs. 25 lakhs at attractive interest rates (as low as 10.99 % per annum) and a repayment tenure ranging from 1 year to 5 years. Moreover, by using Kotak Mahindra Bank’spersonal loan EMI calculator online,you can find the highest EMI for the loan. That way, you can ensure you repay the loan without any hassles. So, before you avail a personal loan, make sure that you use the personal loan calculator to check the expected EMIs.

No comments:

Post a Comment